Proforma Invoice Meaning in Hindi & English (Format & Example)

A Proforma Invoice is a preliminary document issued by a seller to a buyer before the shipment of goods. It provides complete details about the product, price, quantity, delivery terms, and payment conditions. In the import-export business, a proforma invoice helps both parties clearly understand the transaction before finalising the deal.

This article explains the proforma invoice meaning, format, examples, and its use in import-export business.

What is a Proforma Invoice?

A Proforma Invoice is a document sent by the exporter (seller) to the importer (buyer) before the actual sale or shipment of goods. It is not a legal invoice but acts as a quotation or commitment showing the expected cost and terms of trade.

It is commonly used in international trade, especially in import-export transactions, to confirm order details before goods are dispatched.

Proforma Invoice Meaning in Hindi

Proforma Invoice ka matlab hota hai ek preliminary ya advance invoice, jo maal ship karne se pehle buyer ko diya jata hai.

Is invoice me goods ka description, quantity, price, payment terms aur delivery conditions likhi hoti hain.

Ye document importer ko decision lene, bank formalities aur import approval ke liye help karta hai.

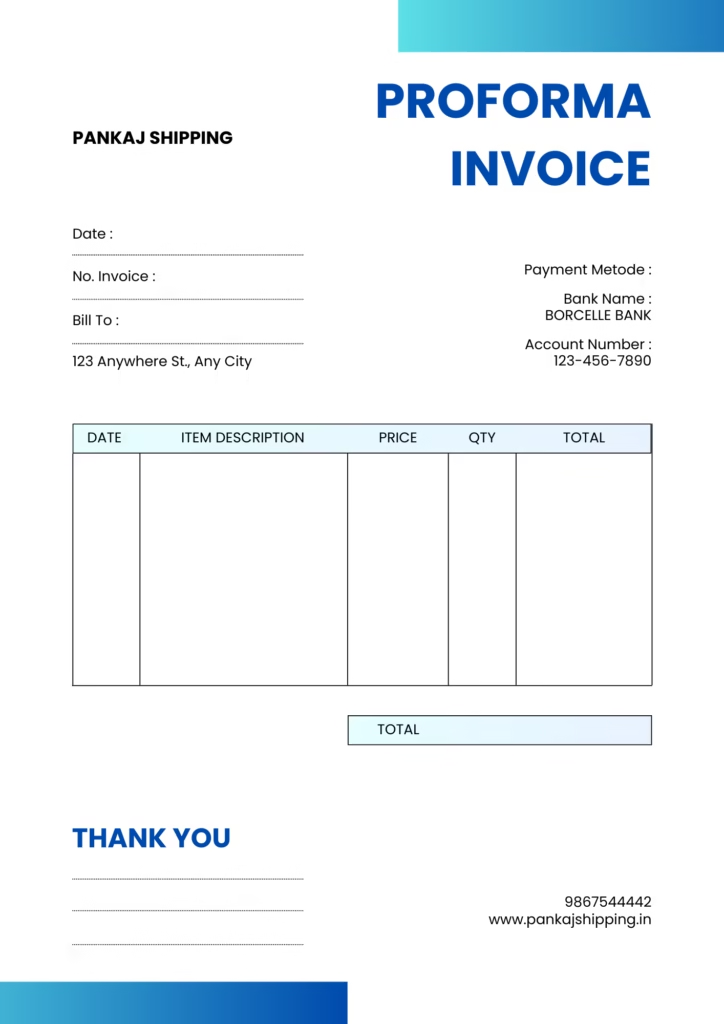

Proforma Invoice Format

A standard proforma invoice usually contains the following details:

Exporter / Seller name & address

Importer / Buyer name & address

Proforma invoice number & date

Description of goods

Quantity and unit price

Total invoice value

Delivery terms (Incoterms like FOB, CIF, etc.)

Payment terms

Expected shipping date

Country of origin

👉 Many banks and customs authorities ask for a proforma invoice during import documentation.

Difference Between Proforma Invoice and Commercial Invoice

| Proforma Invoice | Commercial Invoice |

|---|---|

| Issued before shipment | Issued after shipment |

| Not a legal document | Legal document |

| Used for quotation & approval | Used for customs & payment |

| No tax applicable | Tax applicable |

Why Proforma Invoice is Used in Import-Export Business

A proforma invoice is used in import-export business for many important reasons:

To provide price confirmation to the buyer

To apply for import licenses or permissions

For bank financing and LC (Letter of Credit) opening

To avoid misunderstanding between buyer and seller

To finalize commercial terms before shipment

Example of Proforma Invoice

For example, if an Indian importer wants to import machinery from China, the supplier will first issue a proforma invoice mentioning product details, price, delivery terms, and payment conditions. Based on this document, the importer can arrange funds, open an LC, and complete import formalities.

FAQs About Proforma Invoice

Is a proforma invoice legally binding?

No, a proforma invoice is not a legally binding document. It is issued only for reference and confirmation.

Can payment be made on a proforma invoice?

Usually, advance payment can be made based on a proforma invoice, but the final transaction is completed using a commercial invoice.

Is proforma invoice required for customs clearance?

Customs clearance requires a commercial invoice, but a proforma invoice may be required for pre-import approvals.

Who issues a proforma invoice?

A proforma invoice is issued by the exporter or seller.

Conclusion

A Proforma Invoice plays a very important role in import-export business. It helps buyers and sellers clearly understand pricing, product details, and trade terms before shipment. For smooth international trade and proper documentation, understanding the proforma invoice is essential.