Proforma Invoice Format (Free Download Template)

A Proforma Invoice Format is a structured document used in import-export business to provide complete details of goods, pricing, delivery terms, and payment conditions before shipment. It helps buyers and sellers agree on trade terms before issuing the final commercial invoice.

What is a Proforma Invoice Format?

A proforma invoice format is a standard layout that exporters use to prepare a proforma invoice. It contains all important transaction details such as product description, quantity, price, delivery terms, and expected shipping date.

This format is widely accepted by banks, customs authorities, and importers for pre-shipment approvals.

Standard Proforma Invoice Format

A typical proforma invoice format includes the following sections:

Exporter (Seller) name and address

Importer (Buyer) name and address

Proforma invoice number and date

Description of goods

HS Code (if applicable)

Quantity and unit price

Total invoice value

Delivery terms (FOB, CIF, CFR, etc.)

Payment terms

Expected shipment date

Country of origin

Sample Proforma Invoice Format (Text Example)

Seller: Pankaj Shipping & Transport Co.

Buyer: Importer Name & Address

Proforma Invoice No: PI-001

Date: DD/MM/YYYY

| Description of Goods | Quantity | Unit Price | Total |

|---|---|---|---|

| Product Name | 100 PCS | USD 10 | USD 1000 |

Delivery Terms: CIF Mumbai

Payment Terms: Advance / LC

Country of Origin: India

Free Proforma Invoice Template Download

You can create a professional proforma invoice using a ready-made template. A proforma invoice template helps save time and ensures accuracy.

👉 You can mention here:

“Download our free proforma invoice template in Excel / PDF format.”

(You can add a download button later.)

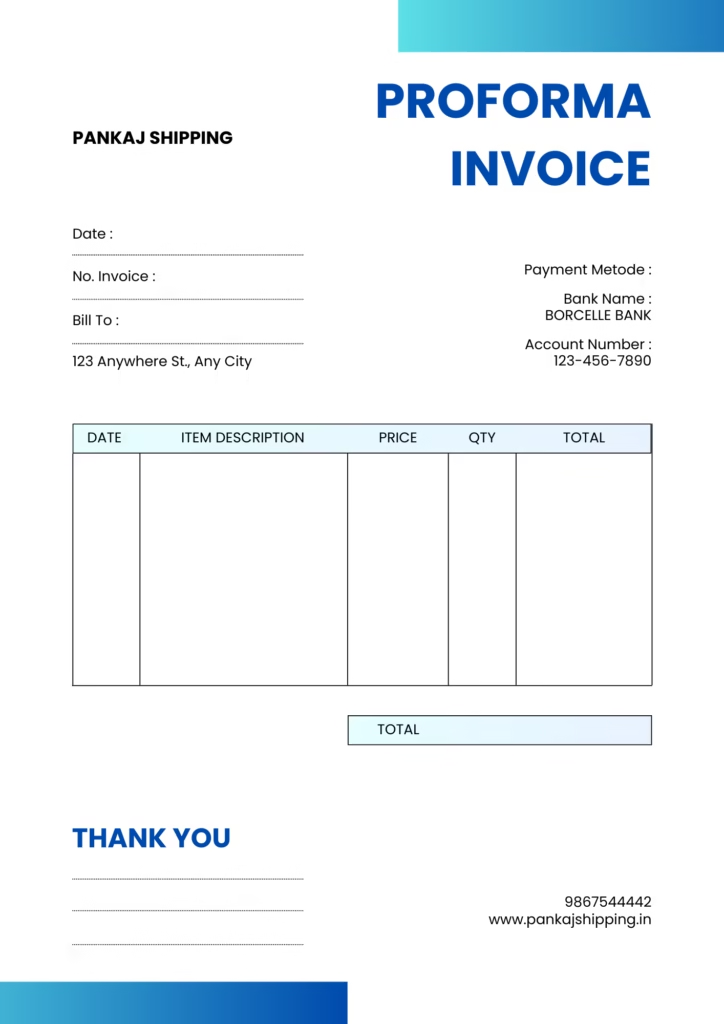

Proforma invoice example format for import export

Difference Between Proforma Invoice and Commercial Invoice

| Proforma Invoice | Commercial Invoice |

|---|---|

| Issued before shipment | Issued after shipment |

| Used for confirmation | Used for payment & customs |

| Not legally binding | Legally binding |

| No tax applicable | Tax applicable |

When is a Proforma Invoice Required?

A proforma invoice is required in the following cases:

Before confirming an import order

For opening a Letter of Credit (LC)

For import license or approval

For buyer’s price confirmation

For bank documentation

Proforma Invoice Format in Import-Export Business

In international trade, the proforma invoice format plays a key role in avoiding disputes. It ensures both buyer and seller clearly understand the transaction before goods are shipped.

Indian exporters and importers commonly use proforma invoices for customs planning and financial arrangements.

FAQs About Proforma Invoice Format

Is there a fixed proforma invoice format?

No, there is no legally fixed format, but standard trade details must be included.

Can a proforma invoice be used for customs clearance?

No, customs clearance requires a commercial invoice.

Can I edit a proforma invoice?

Yes, a proforma invoice can be revised until the final commercial invoice is issued.

Conclusion

Using the correct proforma invoice format is essential for smooth import-export operations. It helps in price confirmation, documentation, and financial planning. Businesses involved in international trade should always use a clear and professional proforma invoice format.