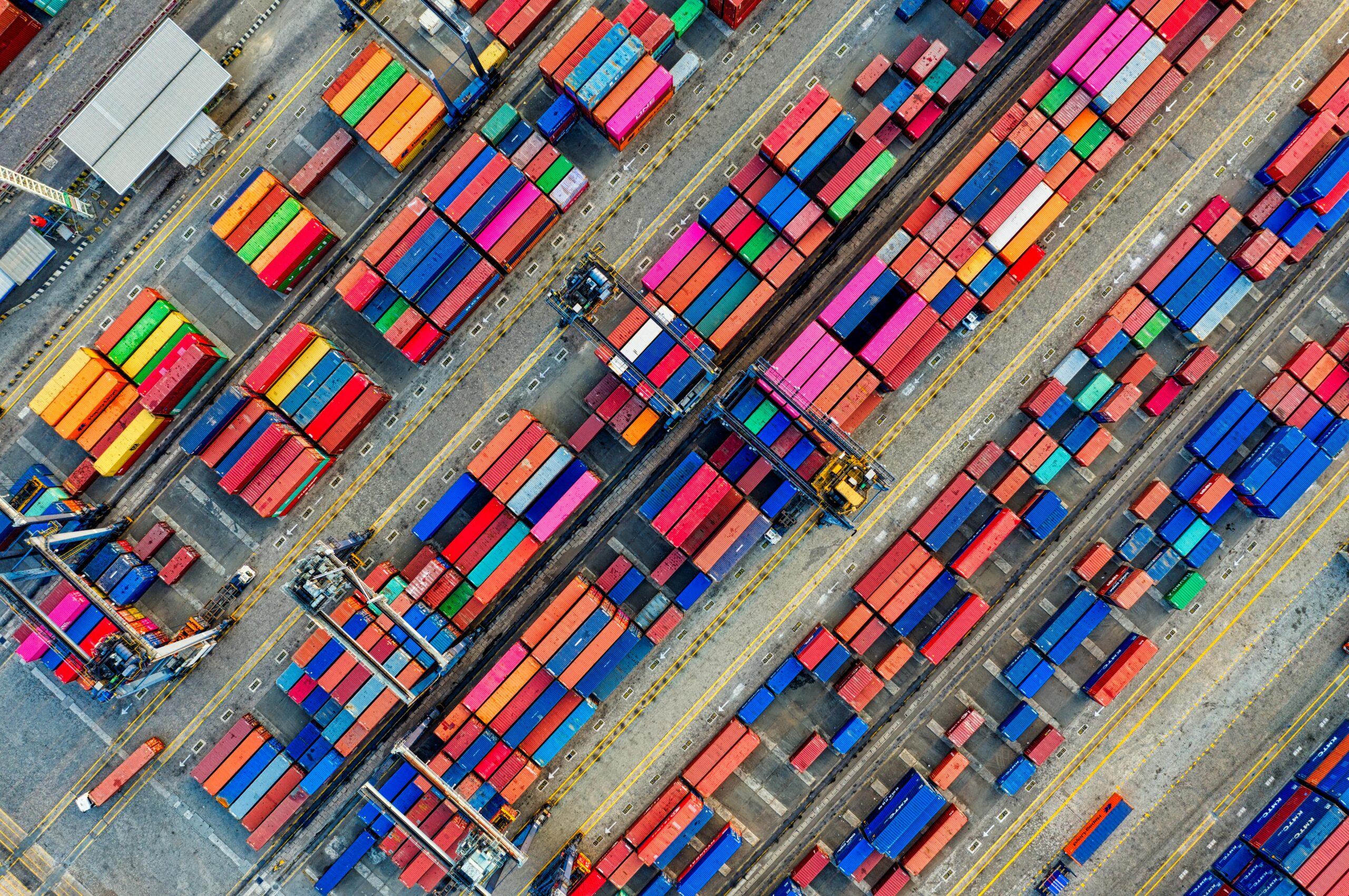

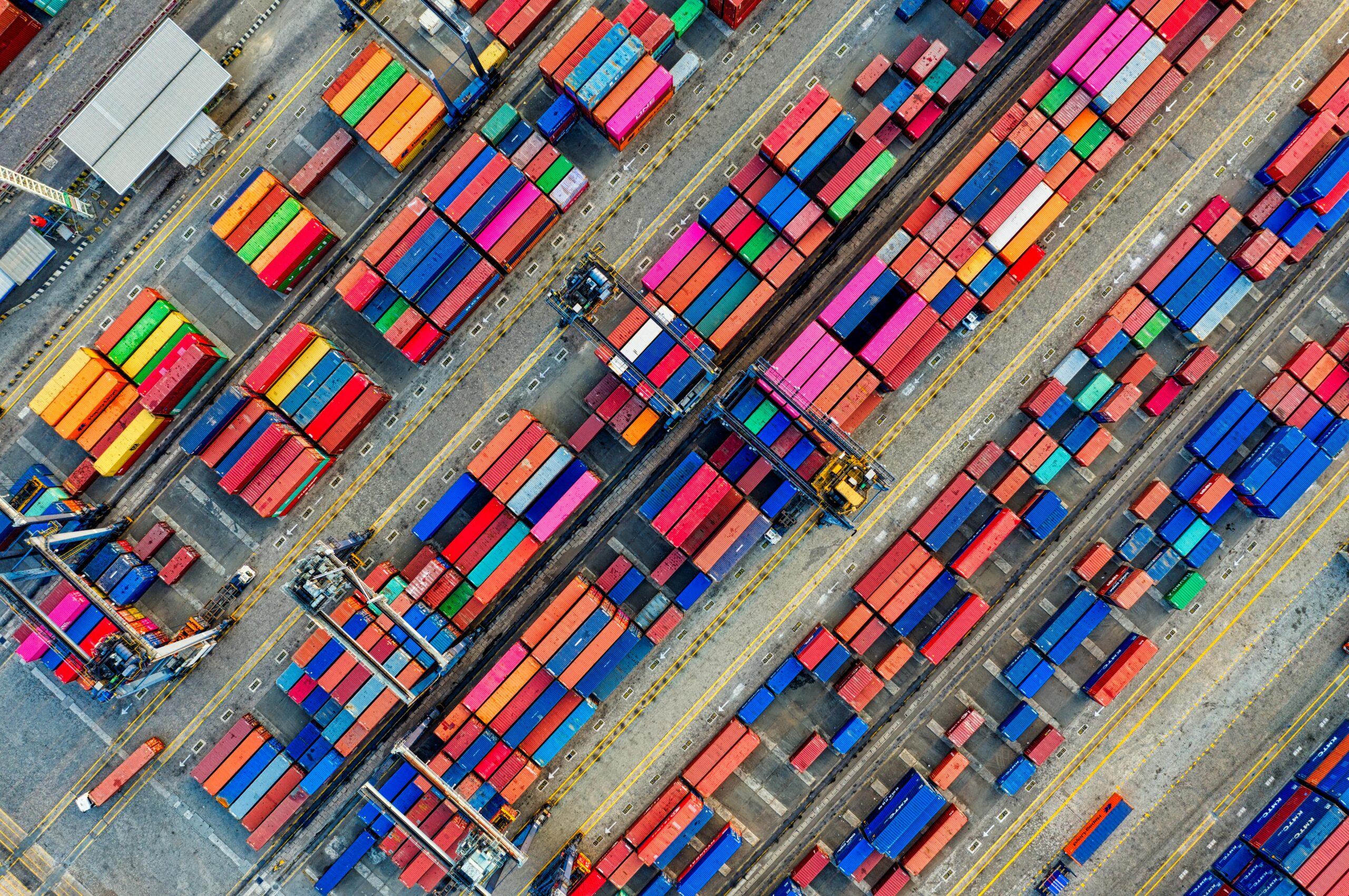

PSNTCO gives you invaluable assistance with the AD Code Registration process at Nhava Sheva Port. Leveraging its expertise and local presence, PSNTCO streamlines the entire registration journey for businesses. By understanding the intricacies of port operations and regulatory requirements, PSNTCO ensures a seamless experience. From documentation preparation to liaisoning with port authorities, PSNTCO handles every aspect diligently. Its proximity to this port enables prompt communication and efficient resolution of any issues that may arise during the registration process. With PSNTCO by your side, navigating the complexities of AD Code Registration at Nhava Sheva Port becomes hassle-free and expedient.

It is required for import-export activities, foreign currency transactions, regulatory compliance, and banking operations. The AD Code streamlines international trade and financial transactions, ensuring transparency and compliance with RBI regulations.AD Code Registration is mandatory for all exporters and importers under Indian Customs regulations. Without a registered AD Code, an exporter cannot generate a shipping bill, which is required to move goods out of the country.Without AD Code registration, you can’t file shipping bills or receive remittances through customs-approved channels.

AD Code must be registered with the Customs House at the port or airport from where the exporter plans to ship goods. This is done through the ICEGATE portal (Indian Customs Electronic Gateway).The documentation required for AD Code registration typically includes KYC (Know Your Customer) documents, proof of business registration, PAN (Permanent Account Number) card, Authorization Letter, company address proof bank statements, and other relevant documents as per RBI guidelines. The specific documents may vary depending on the nature of the business and the regulatory requirements.

Yes, an existing AD Code can be modified or updated — but with conditions. While the 14-digit AD Code itself is fixed (as issued by the bank), you can update or re-register it in certain cases, especially at the customs level or for different ports, changes or updates to an existing AD Code can be made under certain circumstances, such as changes in business structure, address, or authorized signatories